does arizona have a solar tax credit

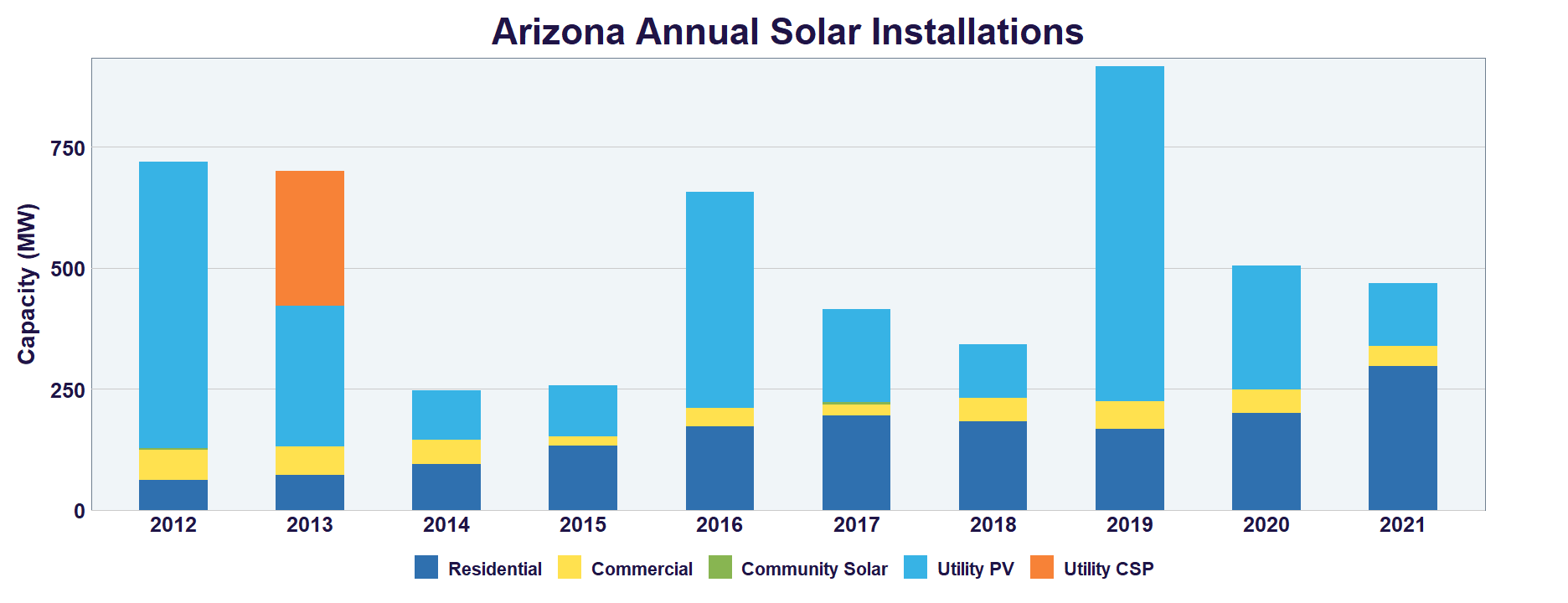

Go Solar Save Up to 60 on Your Monthly Electric Bills In December of 2020 the government passed a massive. Arizona Residential Solar and Wind Energy Systems Tax Credit This incentive is an Arizona personal tax credit.

The Itc Has Been Extended How You Can Leverage It For A New Roof Roof Wolf

If another device is installed in a later year the cumulative credit cannot exceed 1000 for.

. The Solar Equipment Sales Tax Exemption means you dont have to pay. In addition to Arizonas solar incentives youll be eligible for the federal solar tax credit if you buy your own home solar system outright. Federal Solar Investment Tax Credit ITC Arizona Residential Solar Energy Tax Credit Energy Equipment Property Tax Exemption Solar Equipment Sales Tax Exemption Were One of the.

The credit amount allowed against the taxpayers personal income tax is. Of course the federal government isnt the only. June 6 2019 1029 AM This is claimed on Arizona Form 310 Credit for Solar Energy Devices.

The cost of an installed residential solar system in Arizona is about 267 per watt before incentives. Residential Arizona Solar Tax Credit. 23 rows Did you install solar panels on your house.

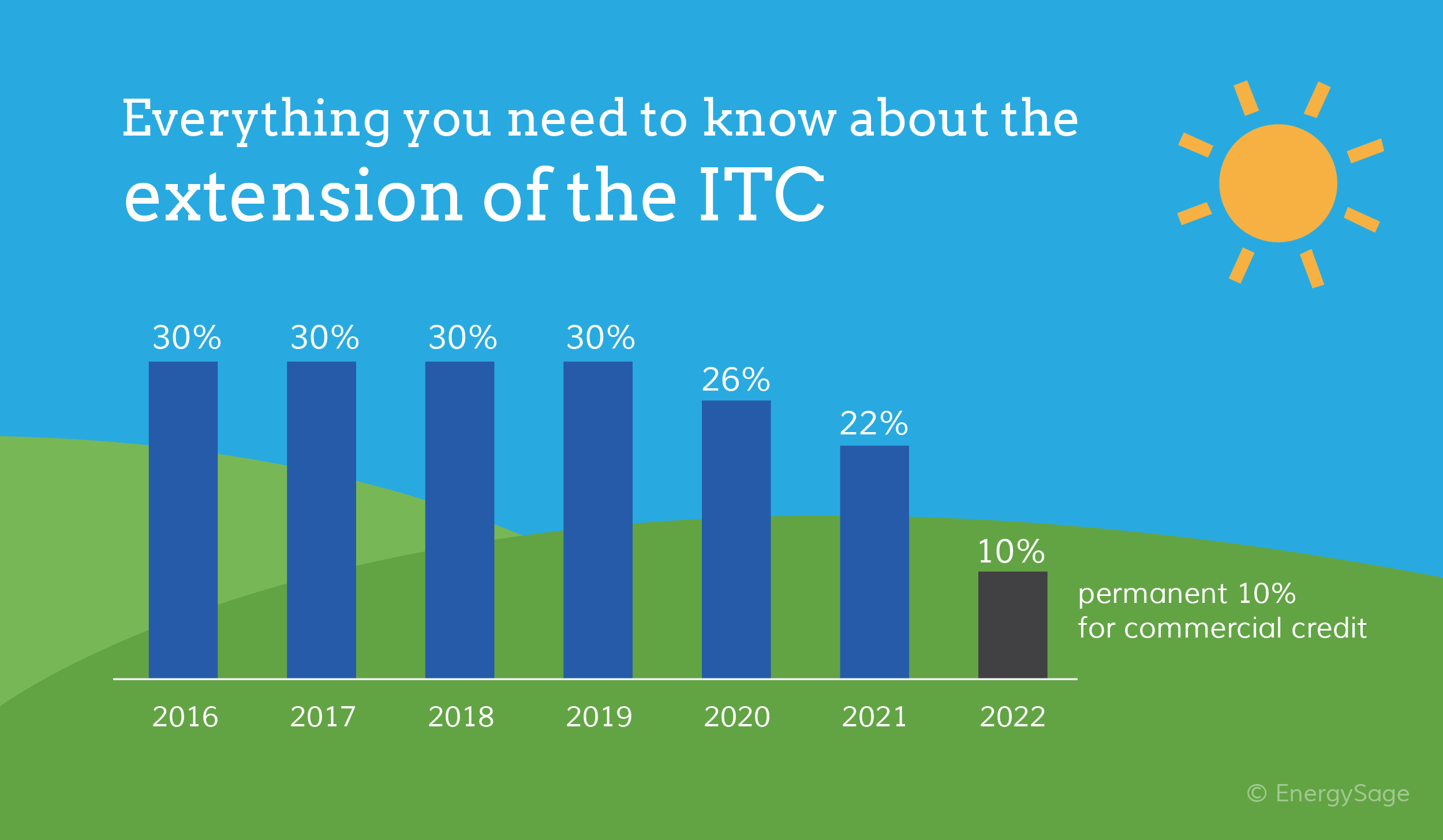

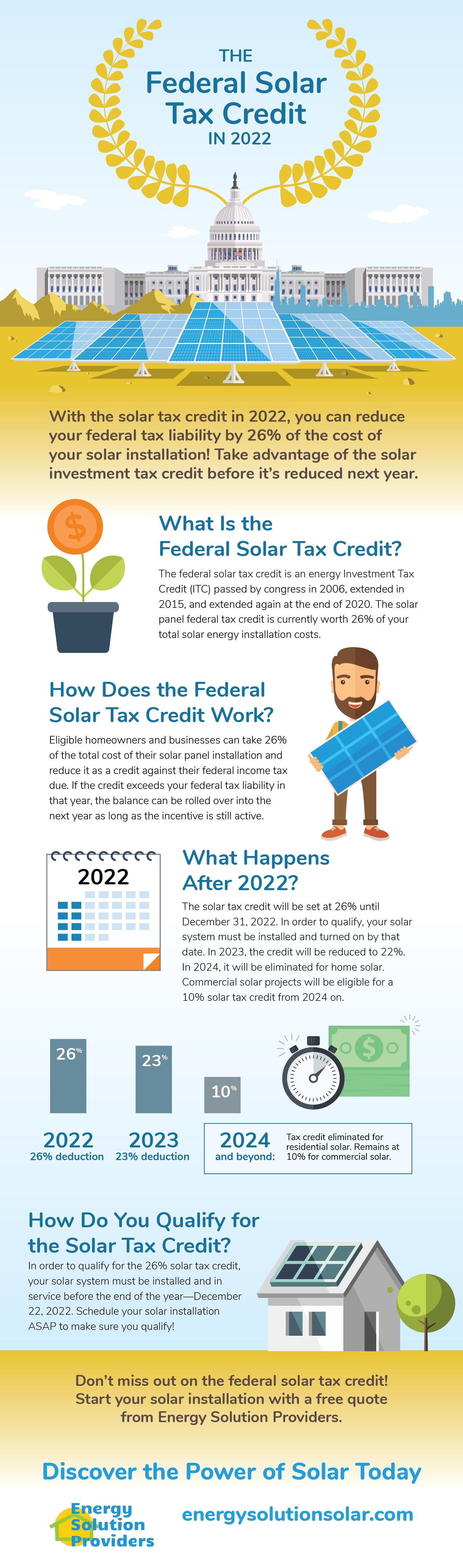

Arizona Residential Solar Energy Tax Credit. The Solar Panel Installation Phoenix AZ Locals Rely On. See all our Solar Incentives by State All Arizonians can take advantage of the 26 Federal Tax Credit which will allow you to recoup 26 of your equipment AND installation.

The federal solar tax credit gives you a dollar-for-dollar. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable. When you invest in solar energy you dont only save on your energy bills but also get tax incentives.

That is a nice bonus to add. After claiming the 26 federal solar tax credit the price is only 198 per. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less.

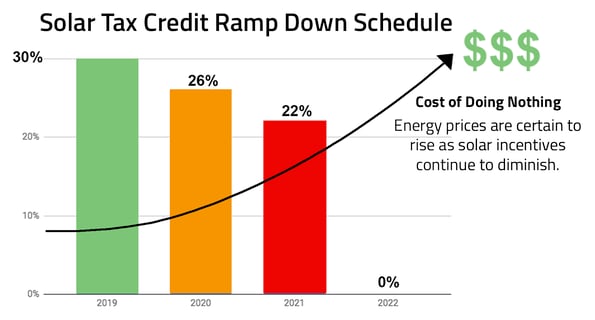

Arizonas Energy Systems Tax Credit An income tax credit is also available at the state level for homeowners in Arizona. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. In 2023 it drops down to 22 before ending permanently for homeowners beginning on January 1 2024.

To claim this credit you must also complete Arizona Form 301 Nonrefundable. Residential Arizona Solar Tax Credit This is a personal solar tax credit that reimburses you 5 of the cost of your solar panels up to 10001000 maximum credit per residence irrespective of. Arizona offers state solar tax credits -- 25 of the total system cost up to 1000.

The 26 solar tax credit is available through the year 2022. The Arizona government provides a 1000 tax credit for solar systems. This tax credit applies to all solar systems installed before December 31 2022.

Arizona state tax credit for solar The most significant solar rebate offered in Arizona is the Credit for Solar Energy Devices from the Arizona Department of Revenue. Every resident in Arizona who installs solar panels gets a State Tax Credit of 25 of the total system cost up to 1000 to be used toward State income taxes. The Arizona Solar Tax Credit lets homeowners enjoy a 25 tax credit up to 1000 off their personal income tax.

For example if your solar PV system was installed before December 31 2022 installation costs totaled 18000 and your state government gave you a one-time rebate of 1000 for installing. The Residential Arizona Solar Tax Credit gives you back 25 of the cost of your. Check out all of the Arizona solar tax credits rebates and incentives.

1000 Arizona Solar Tax. Equipment and property tax exemptions Thanks to the Solar Equipment Sales Tax Exemption you are free from the burden of any Arizona solar tax. When you purchase your system the Residential Arizona Solar Tax Credit takes what you will initially pay for your panels and returns a fraction of the total system price.

Known as the Residential Solar and Wind Energy Systems Tax Credit.

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Solar Tax Credit 2021 Extension What You Need To Know Energysage

The Extended 26 Solar Tax Credit Critical Factors To Know

Cost Of Solar Panels In Arizona 2022 Tips To Saving Money

Is Solar Worth It In Arizona Solar Panels Savings Az Solar Website

2022 Arizona Solar Incentives Tax Credits Rebates And More

Solar Tax Credit Pays For Solar Yuma Solar Pros 48solar

Arizona Solar Tax Credits And Incentives Guide 2022

Solar Tax Credit Details H R Block

Cost Of Solar Panels In Arizona 2022 Tips To Saving Money

3 Solar Incentives To Take Advantage Of Before They Re Gone

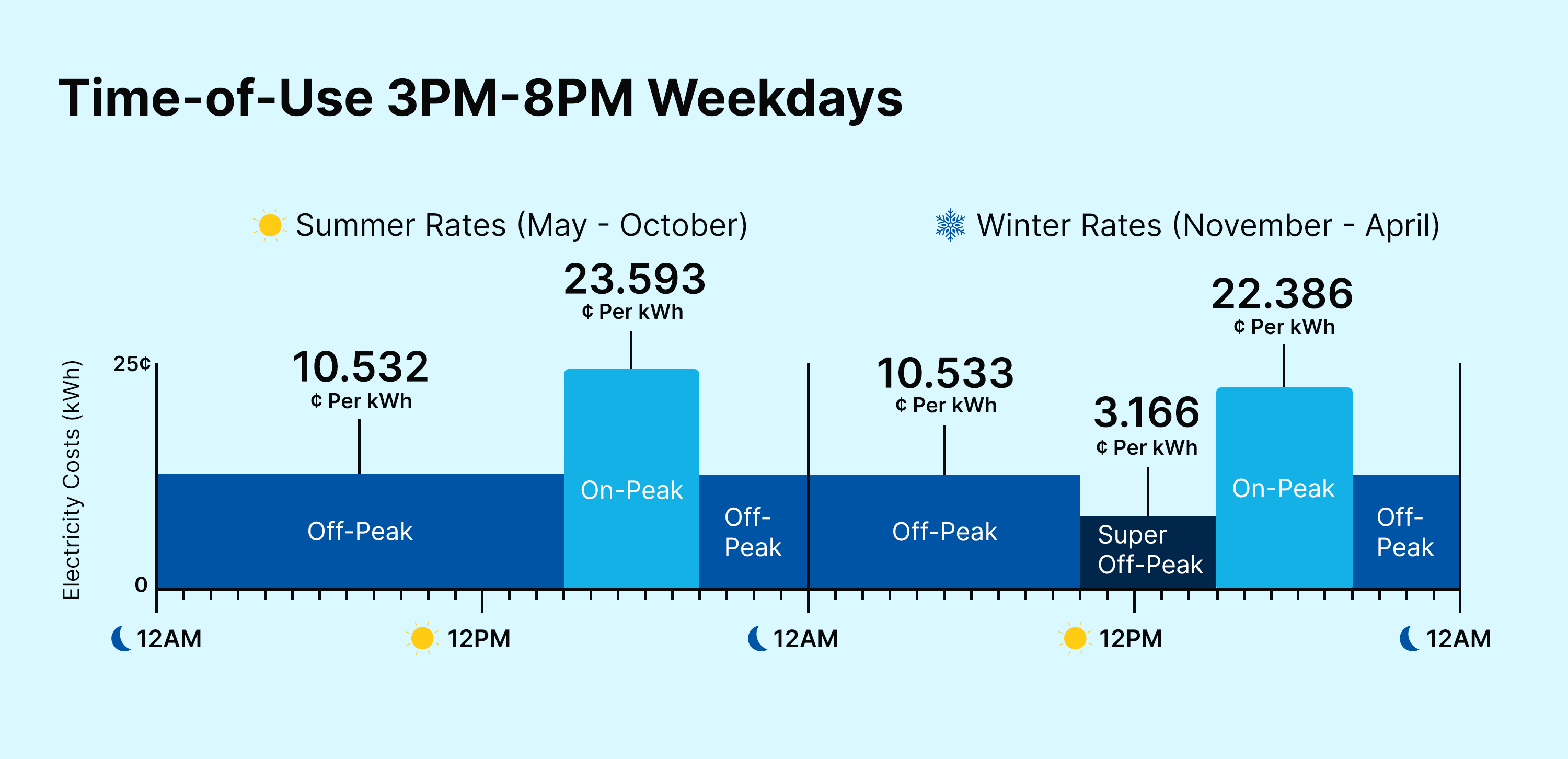

Guide To Going Solar With Arizona Public Service Aps

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home

Arizona Solar Incentives And Rebates 2022 Solar Metric

The Federal Solar Tax Credit Energy Solution Providers Arizona